Secure Your Self-Employed Mortgage: Little-Known Application Secrets

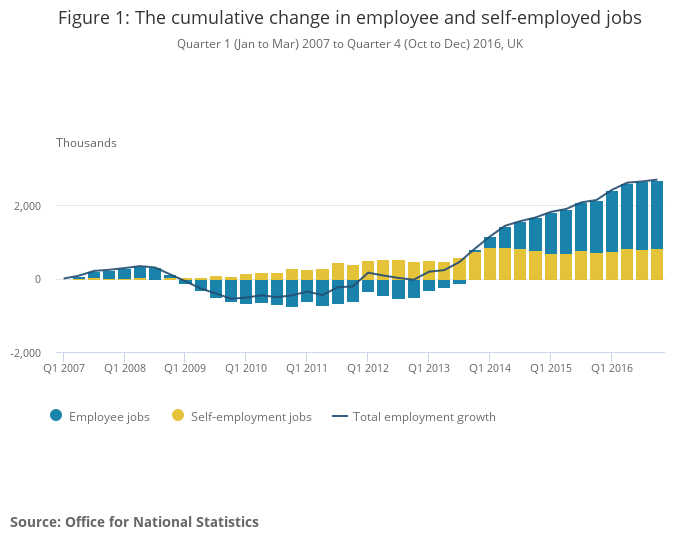

You might be one of the four million self-employed workers in the UK. These entrepreneurs make up 12% of the country’s workforce. But getting a mortgage as a self-employed person can be tough.

Lenders take extra care with self-employed applications, even when you’re financially stable. Most want to see at least two years of self-employment history. They usually limit your borrowing to about four-and-a-half times your income. Your chances drop further if your monthly income goes up and down.

The numbers matter here. A tiny 0.5% bump in interest rates adds almost £2,000 to your payments over three years on a £200,000 mortgage. That’s why knowing how to get through the self-employed mortgage process matters so much to your financial health.

This piece shows you the hidden tips that could boost your approval odds. You’ll learn everything from must-have documents to the right time to work with a self-employed mortgage broker. Let’s explore those strategies that lenders keep close to their chest.

Are You Considered Self-Employed by Lenders?

You need to know how lenders view “self-employed” status before you apply for a mortgage. Many people think their work status is straightforward, but lenders use specific criteria that might catch you off guard.

Sole trader, contractor, or company director?

Lenders look at self-employed applicants differently based on their business structure:

Sole traders run their own businesses and must handle any debts personally. Lenders will look at your net profit figures from tax returns to decide how much you can borrow.

Contractors provide services to businesses for specific periods or projects. You can work through your own limited company or as a sole trader. Some lenders work out your income by multiplying your day rate by the number of working days in a year (usually 46-48 weeks). Daily rate contractors earning less than £50,000 yearly need at least 2 years’ contracting experience.

Company directors with a big stake in their business face special considerations. Most lenders see you as self-employed if you own more than 20-25% of company shares. The exact percentage varies – some use 25%, others 20%, and at least one main lender sets it as low as 10%.

How lenders define self-employment

Lenders usually see you as self-employed if you own at least 20-25% of a business that provides your main income. This includes many different work arrangements beyond just owning a business.

Freelancers usually count as self-employed, though each lender might see it differently. Agency workers and people paid through umbrella companies usually aren’t self-employed, but they might face similar challenges getting a mortgage.

Lenders will subtract employer costs and payroll service fees from your gross pay if you’re a contractor working inside IR35 rules or through umbrella companies. Zero-hour contracts, fixed-term employment, and agency contracts might work if you’ve done similar work for 2 years.

Both applicants’ shareholdings get combined by some lenders. If you and your partner each own 15% of a company and the lender’s limit is 25%, they might see you both as self-employed.

Why this matters for your application

Your status changes how lenders look at your income and decide your borrowing limit. Lenders typically check sole traders’ net profit in the last 2-3 years and take an average. Limited company directors get assessed on salary and dividends, while contractors often have their day rate calculated yearly.

This difference matters most for company directors. High-street lenders usually only look at your salary plus dividends to work out what you can borrow. Specialist lenders might include your share of kept profits, which could let you borrow much more.

Let’s say you have £50,000 in salary and dividends but your company makes £250,000 in profit. Regular lenders might offer up to £250,000 (4.5 times £50,000), but specialist lenders looking at company profit could go up to £1,250,000.

Knowing these differences early in your mortgage process helps you show your finances in the best light and get specialist help if needed.

What Documents Do You Need to Apply?

Getting a mortgage when you’re self-employed needs proper preparation and the right paperwork. Your lender will want proof that your income is stable. Starting the documentation process early will make your application much smoother.

Certified accounts and SA302 forms

You’ll need certified accounts as proof of your income. Most lenders want to see two to three years of accounts, though some might ask for four years. A qualified accountant should prepare these accounts to boost your credibility with lenders.

The SA302 tax calculation is a vital document that gives a complete summary of your income and tax liability for each tax year. This form has:

- Your total income from all sources

- Income tax owed and paid

- National Insurance contributions

- Profit figures (for sole traders or partnerships)

- Any other income sources such as investments

Lenders need your tax year overview from HMRC with your SA302 to verify your tax status. These documents together prove your declared earnings definitively.

The way you get these documents depends on how you file taxes:

- You can print these documents yourself if you use HMRC’s online services or commercial software

- Your accountant can provide them if they handle your returns

- HMRC needs up to two weeks to deliver documents to paper filers

Bank statements and proof of deposit

Lenders typically want three to six months of personal and business bank statements. These statements help:

- Verify your recent income matches declared earnings

- Show your spending habits and money management skills

- Confirm steady business income

Your bank statements must have:

- Your full name and address

- Bank account and sort code numbers

- All pages with running balance

- Proof of regular outgoings matching your application

Lenders need proof of your deposit’s source to meet anti-money laundering rules. Different sources need different proof:

- Personal savings: Statements showing money growth over six months

- Gifted deposits: A formal signed letter confirming the gift isn’t a loan

- Gifts over £10,000 might need extra documentation

Evidence of upcoming work or contracts

Your future income stability can make your application stronger. Lenders might ask for:

- Business plans with projected figures

- Signed contracts for future work

- Evidence of past, current, and future contracts for contractors

Contract workers usually need 12 months of work history or 24 months left on their current contract. Remember to include all contract pages with signatures from you and your employer.

A self-employed mortgage broker can be a great way to get guidance on exactly what documents your chosen lender needs. Different lenders have different requirements, so professional advice could save time and boost your approval chances.

How Lenders Assess Your Income and Risk

Lenders use specific methods to review your income and risk level when you’re self-employed. You can boost your mortgage approval chances by knowing how these assessment techniques work.

Averaging income over 2-3 years

Your financial track record matters more to mortgage providers than just your current earnings. Lenders usually check a sole trader’s net profit from the last two to three years to calculate an average. Limited company directors get assessed on their salary plus dividends instead of the company’s total turnover.

Each lender handles averaging differently. While some take a simple average across all years, others might:

- Use your most recent year’s figures if your income keeps rising

- Pick the lower figure when your income goes up and down

- Calculate an average from your last few years’ income for contractors

Some lenders have changed their assessment methods. To name just one example, they now look at either your latest year or a two-year average—picking whichever is lower—for self-employed applications with income up to £50,000.

Impact of irregular income or gaps

Your mortgage application faces a big challenge with changing income. Lenders might use your lowest earning year as their baseline if your earnings swing widely between years. This careful approach helps them manage the risks that come with unpredictable income.

Contract gaps can make things tricky. Lenders might worry if you have gaps longer than eight weeks. They see unsteady income as a sign you could struggle with monthly mortgage payments.

Your income source shapes how lenders see your risk level. Single-client revenue makes you a higher risk than having multiple income streams. That’s why contractors or freelancers with various clients often get better consideration.

Loan-to-value and affordability checks

The loan-to-value (LTV) ratio is vital for self-employed mortgage applications. Self-employed borrowers often get limited to 85-90% LTV while employed applicants can access 95% or even 100% deals. All the same, some building societies now offer up to 95% LTV to self-employed borrowers.

Lenders look beyond just income with their complete affordability checks that cover:

- Testing to see if you can handle payments when interest rates go up

- Looking at your debt-to-income ratio (best kept under 40%)

- Checking your regular expenses and financial commitments

Lenders need proof that you can make payments now and handle future rate increases. They usually won’t lend more than 4.5 times your assessed income, though specialist lenders might stretch to 5.5 times in special cases.

A qualified self-employed mortgage broker can be your best resource, especially with complex income streams or changing earnings patterns.

Little-Known Ways to Improve Your Approval Odds

Several lesser-known tactics can greatly improve your chances of getting a mortgage while self-employed. These practical strategies help address specific lender concerns about self-employed applicants.

Avoid switching business models too soon

Your mortgage application can face serious problems if you change your business structure right before applying. Many lenders will treat you as a new business if you switch from being a sole trader to a limited company—whatever your actual trading history. This often leads to rejection. You should wait at least one year after switching your business model before applying.

Limit business expenses before applying

Smart management of your business expenses matters in the months before your application. While claiming tax-deductible expenses helps your tax position, it can make your income look lower. Lenders look at your taxable income to calculate what you can afford, so high expense claims can reduce your borrowing power. Talk to your accountant about cutting back on expense claims in the year before you apply.

Use a self employed mortgage broker

Specialist brokers with self-employed mortgage experience are a great way to boost your chances. They know which lenders work best with self-employed applicants and can explain your business model to them effectively. Many brokers have built strong relationships with underwriters at various lenders, which helps them support your application better than you could on your own.

Register to vote and check your credit file

Your presence on the electoral roll helps lenders verify your identity and address easily. This simple step improves your creditworthiness and makes the application process smoother by reducing extra identity checks. You should check your credit report before applying to fix any errors that could hurt your score. Even small mistakes can lead to rejection, so check everything carefully.

Get an agreement in principle early

An agreement in principle (AIP) early in your house-hunting brings multiple benefits. You’ll know exactly what you can afford. Sellers and estate agents will see you as a serious buyer who has taken real steps toward getting financing. Best of all, you can spot and fix potential application issues before finding your ideal property. Your AIP usually stays valid for 60-90 days—plenty of time to find a property.

These strategies will make you a stronger applicant, which could help you access better rates and higher borrowing limits despite being self-employed.

Finding the Best Self Employed Mortgage Deals

Getting a competitive mortgage deal needs smart planning. This becomes even more crucial if you need a mortgage while being self employed.

Why deposit size matters more than you think

A substantial deposit can change your mortgage prospects completely. Lenders see you as less risky with a larger deposit, and you’ll get access to better interest rates. A bigger deposit does more than just lower your monthly payments – it brings down your loan-to-value (LTV) ratio and helps you discover better product terms. Most self-employed people find it easier to get better rates with 10-15% deposits. Those with complex income might want to aim for 20-25% deposits.

How to compare deals without hurting your credit

Online mortgage comparison tools let you check available rates without any impact on your credit score. The next step is getting an Agreement in Principle that shows what you can really borrow, and it won’t affect your credit profile. Note that affordability calculators just give you a rough idea – the actual amount depends on how lenders calculate self-employed income.

When to use a specialist broker

A self employed mortgage broker makes sense if your income structure is complex. These experts know which lenders work well with different types of self-employment – whether you’re a sole trader or run a limited company. They’ve built relationships with underwriters who get self-employed applications, and might find deals you can’t access on your own.

Conclusion

Self-employed individuals face unique challenges when looking for a mortgage. Good preparation and knowing what lenders want will boost your chances of getting better terms.

Your documentation is the life-blood of a successful application. Beyond your varying monthly income, certified accounts, SA302 forms, and bank statements show your financial stability. You should keep your business structure consistent before applying to avoid complications that could hurt your application.

Smart timing of your mortgage application makes a big difference. Lenders feel more confident about your income stability when you have at least two years of accounts with your current business model. Your taxable income should reflect your true earning potential, so manage your business expenses well in the year before you apply.

The size of your deposit will give you access to better rates without doubt. Better options become available with each percentage point above the minimum requirement. Lenders see you as financially responsible. A clean credit file and voter registration are the foundations of your strong application.

High street lenders often use strict assessment criteria. However, specialist lenders and experienced mortgage brokers know the ins and outs of self-employed finances. They often find suitable mortgage products that standard providers miss. They can explain your business model to underwriters and potentially increase how much you can borrow.

Getting a mortgage might seem harder when you’re self-employed, but these insider tips can turn obstacles into manageable steps. With proper planning, right documentation, and expert help, you can get a mortgage that reflects your true financial position, not just your tax-efficient income. Being self-employed shouldn’t stop you from owning your dream home.

Key Takeaways

Self-employed mortgage applications require strategic preparation and insider knowledge to overcome lenders’ heightened caution. Here are the essential secrets that can dramatically improve your approval odds:

• Timing is everything: Avoid changing business structures before applying—lenders treat new business models as starting from scratch, regardless of trading history.

• Manage expenses strategically: Reduce business expense claims in the year before applying, as excessive deductions lower your taxable income and borrowing capacity.

• Documentation is your lifeline: Prepare 2-3 years of certified accounts, SA302 forms, and bank statements early—these prove income stability beyond monthly fluctuations.

• Deposit size unlocks better deals: Aim for 15-25% deposits to access competitive rates and demonstrate lower risk to lenders who cap self-employed LTV ratios.

• Specialist brokers provide insider access: Use experienced self-employed mortgage brokers who understand which lenders accommodate different business structures and have established underwriter relationships.

• Credit fundamentals matter more: Register to vote and maintain a clean credit file—these simple steps enhance creditworthiness and streamline identity verification processes.

The key to success lies in understanding that lenders assess self-employed applicants differently, often using conservative income averaging over 2-3 years. By implementing these strategies and potentially working with specialists, you can secure mortgage terms that reflect your true financial position rather than just your tax-efficient income structure.