Let's get

remortgage ready

Regulated by the FCA

By continuing you agree to our Privacy Policy and to be contacted by one of our mortgage experts.

Your home may be repossessed if you do not keep up repayments on your mortgage. Mortgageable is a mortgage broker, and not a lender.

Remortgage

Rates & Deals

There are a variety of reasons why you might be looking to remortgage and our team of experts are on hand to help with any queries you may have and to provide the best rates & deals.

A few reasons you might want to remortgage:

• Your current deal is about to end.

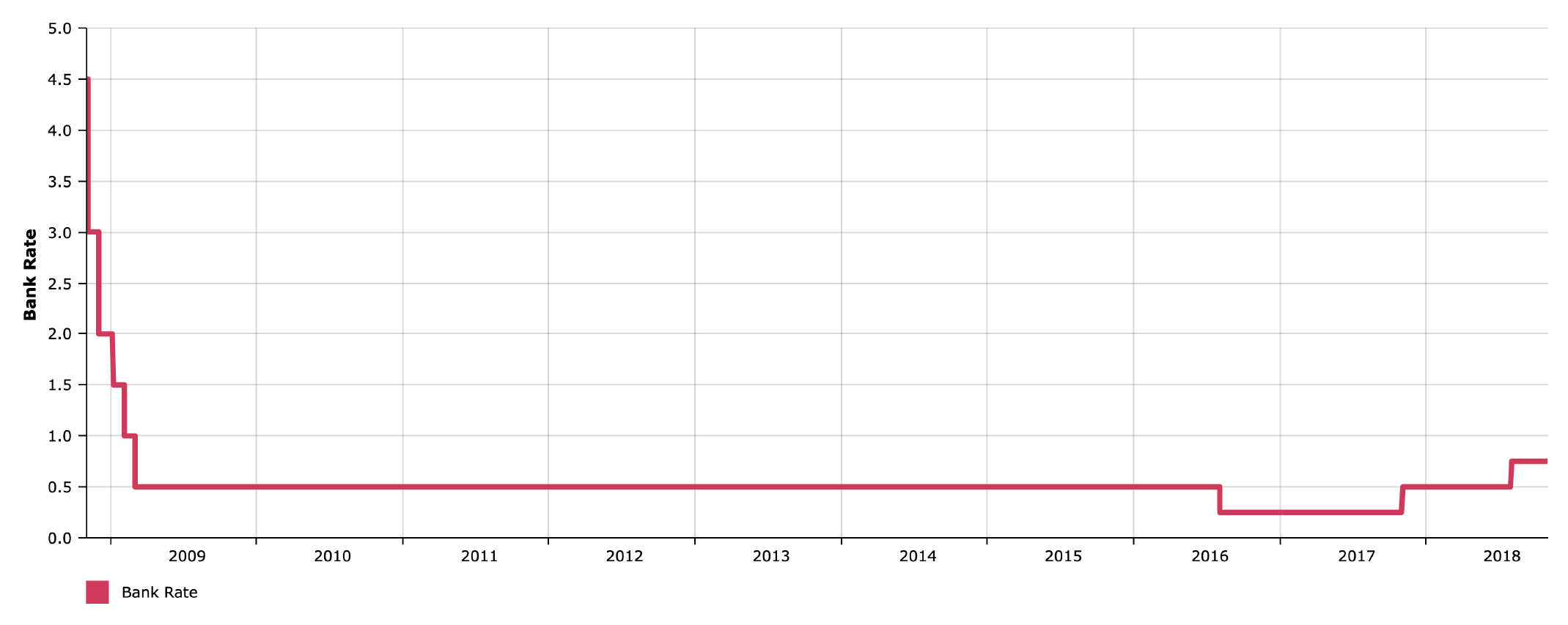

• You’re looking for a better rate.

• Your home’s value has gone up.

If you match any of the above, great. It’s time to start looking for a remortgage deal.

Remortgage Questions.

Below are a few common questions we get asked about remortgages that may be useful.

A remortgage means changing your existing mortgage deal.

This may mean changing your existing mortgage with your current lender or switching to a new lender.

Many people remortgage their property to find a more competitive interest rate and terms.

Speak to an expert.

Unsure which mortgage is best for you? Struggling to understand the rates? Book a call with one of our experts.