If you have dreams of purchasing property, a mortgage can help make your dreams a reality, whether it’s a home or buy-to-let property.

Getting onto the property ladder can be daunting, but it doesn’t have to be stressful with a bit of planning and the correct information.

Here’s everything you need to know about getting a mortgage in the UK, including how much you need to earn, what factors lenders consider, the repayments to expect, and how the deposit affects your chances.

How Much You Need To Earn To Get A Mortgage

How much you need to earn to get a mortgage will vary from lender to lender.

Most lenders will determine how much they’re willing to lend you depending on multiples of your salary.

Provided you’re eligible, most offer four times your annual salary, and some will offer five times, while a few can stretch it to up to six times under the right circumstances.

Lenders will usually base their decision 0n your loan to income ratio, which refers to the amount you want to borrow divided by how much you earn.

Affordability assessments are usually based on:

Income

One of the things the lender will look at when calculating how much you can afford to borrow is your income.

It can include your primary income, income from other sources like your investments, pension, financial support, child maintenance, or other earnings like freelancing or a second job.

Bank statements or payslips may be necessary to prove your income. If you’re self-employed, lenders may require business accounts, bank statements, or details of the income tax you’ve paid.

Typically, they’ll ask for two to three years’ worth of business accounts or tax returns.

Need more help? Check our quick help guides:

- Reasons why a mortgage could be declined on affordability.

- How reliable is a mortgage in principle?

- How do joint mortgages work?

- Can you get a mortgage on a fixed-term contract?

Outgoings

Your outgoings include the monthly or daily expenses you have to make for everyday living.

They can consist of maintenance payments, credit card payments, insurance for buildings, life, travel, or pets, any credit agreements or loans you might have, and any bills incurred like water, electricity, gas, broadband, or phone.

You may also need to provide estimates of your living costs, like how much you spend on child care, primary recreation, or clothing. Recent bank statements or receipts may be needed to back up the figures you provide.

The lender’s decision can be impacted if you already have significant financial commitments like car finance, personal loans, and debt.

Possible Changes

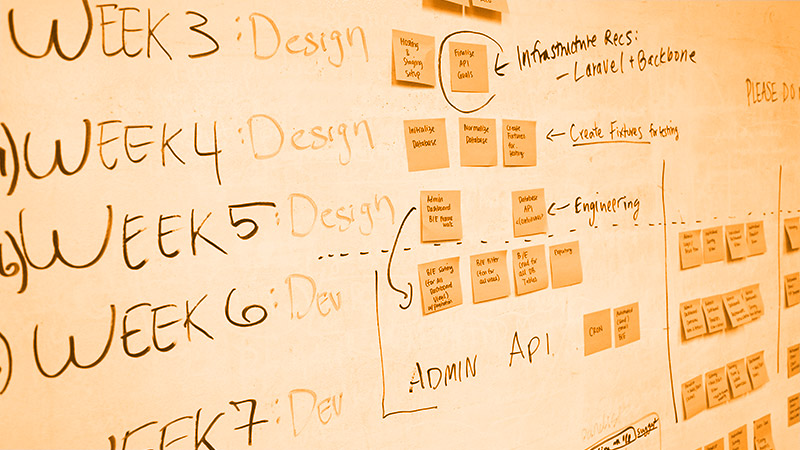

Mortgage affordability assessments will also consider any future changes that might impact your ability to repay the mortgage amount.

They’ll stress test your situation to ensure you’re capable of repaying the mortgage if there are changes in your lifestyle like having a baby, redundancy, or taking a career break.

Interest rates can also increase, you may fall ill, or you and your partner may lose their jobs.

A mortgage is one of the biggest and longest commitments you’ll ever make, and you must plan to ensure you can meet your obligations in case anything happens.

You can try and invest in other forms of income when you can or protect yourself against income reductions by making savings when possible.

A lender can limit how much you can borrow if they suspect you won’t afford your mortgage repayments in case of such circumstances.

Related guides:

- Mortgage 5 times salary.

- Can you get a mortgage on land?

- Refurbishment mortgages.

- Part and part mortgages.

- HMO mortgages.

What Repayments Will You Make?

Different factors will influence your monthly repayments for a mortgage. The interest rate you get from the lender and the length of the mortgage are the most critical factors.

Remember, all lenders are not the same, and they’ll use different criteria in determining the rates they give you. Your profile, credit history, and deposit you put down can influence the rate a lender is willing to provide you with.

Interest Rates

The monthly repayments for all loans are affected by the interest rate. The mortgage rate you get will largely be influenced by your deposit level and your profile as a borrower.

Most mortgage lenders in the UK provide interest rates from 1% to 5%. The interest is usually added to a portion of the capital or loan amount and repaid each month for the mortgage duration until you clear the loan.

Lenders may provide you with an interest-only or capital repayment plan. In an interest-only plan, you’ll only repay the interest on the mortgage every month and nothing off the capital.

The capital or borrowed amount becomes due at the end of the loan term in a huge lump sum.

With interest-only plans, it’s easy to accumulate a huge debt that can be difficult to repay. Lenders will require you to show a viable repayment strategy that assures them you’re capable of covering the entire balance at the end of the loan term.

You’ll get lower monthly repayments because you’re not paying anything off the capital amount.

However, you may also need a large deposit to qualify. If you get a capital repayment mortgage, you repay the interest plus a percentage of the capital every month for the entire loan duration.

The Duration

The duration or term of the mortgage also significantly affects monthly repayments and how much you’ll ultimately pay in total. Most lenders in the UK offer mortgages with durations of 5 to 30 years.

You’ll get cheaper monthly repayments with an extended loan period, but you’ll repay a higher total amount for the mortgage than a shorter period. You can save a lot by repaying your loan earlier because the interest compounds each month.

Although the monthly repayments will be higher, you’ll pay less on the amount with a shorter mortgage duration.

It’s recommended that you only choose a mortgage term or period based on the amount you can realistically afford to repay each month.

How The Deposit Affects Your Chances For A Mortgage

The deposit you’ll need for a mortgage will depend on the ratio of the loan to value (LTV). It’s basically what the lender is willing to offer relative to the value of the property you’re eyeing and is usually expressed as a percentage.

Mortgage applications with low deposits are seen as higher risk resulting in fewer lenders giving it due consideration. Those who consider it can apply unfavourable terms and higher interest rates to mitigate the perceived risks.

The best rates and terms are offered to borrowers with low LTV ratios. While it’s possible to find lenders who offer mortgages with up to 95% of the property value, they’ll not feature the best deals available.

You should always aim for 20% and above deposits to ensure you get the best terms with affordable monthly repayments. Such deposits are the standard for attractive mortgages. With a high deposit, you’ll have a lower interest and loan amount to repay monthly and in total.

Mortgages With Bad Credit

Having bad credit isn’t necessarily a deal-breaker when you’re looking for a mortgage. The number of lenders available to you may be limited, but you can still find lenders who specialise in providing mortgages to bad credit borrowers in the UK.

Mortgage lenders will view you as higher risk when you have bad credit, and you may need a higher deposit and pay higher interest rates to offset the risk. With higher interest, you get higher monthly repayments.

However, all lenders are different, and you can still qualify for reasonable rates and terms depending on the severity and recency of your bad credit issue.

Mortgage advisers and brokers can be beneficial as they have access to the entire market. They can help you get the best deals based on your circumstances.

How Much Do You Need To Earn To Get A Mortgage? Final Thoughts

Getting a mortgage is about more than how much you earn each month, and you have to consider your monthly expenses, affordability, the deposit you can put down and your profile as a borrower.

Call us today on 03330 90 60 30 or contact us. One of our advisors can talk through all of your options with you.

Further reading: